- "What makes you qualified to do this?"

I'm not. - "?!?"

Well, ok, I was good with story problems in grade school. My father was an accountant. I've seen people talk about life insurance on TV. ... Seriously, I'm just a computer programmer with a background in graphics, embedded software, and graphical user interfaces. When I bought my policy, it was a mystery begging to be taken apart and understood. I've done my best, but only the actuaries deep in some dungeon at the New York Life Building will be able to determine how good my analysis is.

New York Life - "Rich, how do you earn money from this site?"

Um, I don't. I pay for the web space and put in my own time to author The Visible Policy. So it costs me money; it does not earn any. (Now you know I am not a qualified financial expert! ;) - "Rich, can you help me decide ... ?"

No! I don't know anything about your circumstances, nor do I have the time to do special analysis for strangers. Sorry. Insurance agents and fee-only financial consultants are trained and licensed (and get paid) to help you make financial choices. Be careful with your money, get outside opinions from friends and family, then do what makes sense. The fact that you are reading this shows that you are doing some research on your own. Keep up the good work. - "Rich, can you provide the spreadsheet in Microsoft Excel ® format?"

No. I am not licensed to use Excel nor distribute documents in its proprietary format. The OpenOffice.org ® spreadsheet uses a non-proprietary format which anyone is free to use as they wish. I am a strong believer that the web should be 100% open, and totally free of proprietary limitations. OpenOffice.org is perfectly capable of loading and saving Excel spreadsheets, but I cannot know if you are a licensed Excel user. Hopefully Microsoft will adopt open standards and support the OpenOffice.org spreadsheet format. If not, and you actually have a licensed copy of Excel, ask Microsoft to support the OpenOffice.org file formats.- OpenOffice.org ® is free and currently available for the various 32-bit flavors of msWindows, as well as UNIX and Linux. A Macintosh version should be available soon. If you are a programmer and want the source code, it is available at 'www.openoffice.org'.

- Microsoft Office ® costs hundreds of dollars. Um, did you say something about wanting financial advice... ?

- "(What a nerd!)

I guess you don't want any feedback then, right?"

Actually I'd love to get feedback. Corrections, suggestions, ideas, money, etc. are all welcome. If there is enough interest, I may even add a bulletin board to this site. (You're not the only one who can whisper, buddy.)

- "{blushes}

Rich, your site is boring."

That is not a question! So I get to ask you one. Could we compromise on the phrase, "extraordinarily plain"? - "Rich, do you gotta be so complicated?"

Sorry; I try to explain clearly and thouroughly, and sometimes -| ahem!

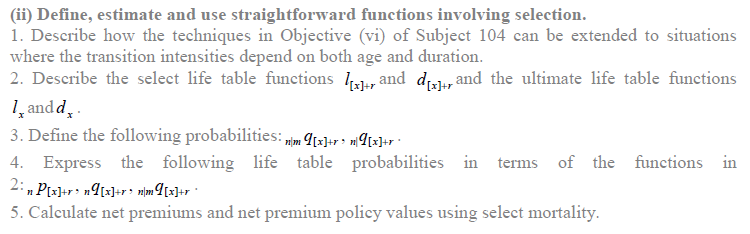

Fred the Actuary interrupts: Rich, I'll handle this one. Complicated? That's funny. Here is complicated, a little tidbit from one of my first year courses on life insurance: You don't even want to know what we went through the second year. If you ever found out, we'd have to recruit you.

Uh, thanks, Fred. - "Rich, why do you have so much text per line?"

You control how much text per line, not me! Make your browser skinnier. - "Is permanent life insurance a financial investment?"

Yes.

Uh-oh -- Now insurance commissioners in 20 states know that I am unqualified to do this. They tend to frown on anyone using "life insurance" and "investment" in the same sentence without the word "not" in-between. Fortunately for me, my only connection with insurance companies is ownership of a policy. I am not trying to sell anyone anything. I am not recommending purchase of anything.- Here is Rich's Definition of a profitable investment:

If the long-term value of out-of-pocket money increases faster than the expected inflation rate, that money was profitably invested.So, a permanent life insurance policy bought from an honest, well-run, established, insurance company will likely be an investment. On the other hand, money placed in a bank's absurdly-named "savings account" will likely be sucked dry.

- Note that I emphasized "long term". If you purchase permanent life insurance but let the policy lapse in less than ten years, you likely made a terrible investment. Your money would have actually been better invested in that savings account. After a decade, your investment should start gaining real value, more than making up from losses incurred in the first few years of the policy.

- Here is Rich's Definition of a profitable investment:

- "Can one use a whole life policy to 'be your own banker'?"

Yes, it can work well. It is certainly not for everyone, though. Basically it involves taking disciplined policy loan(s), making sure to at least pay the premium and interest annually so your policy does not actually lose value. Eventually, you will pay back the principle as well. Do an internet search for "be your own banker" if the idea intrigues you. It does not really intrigue me. Here is a list of items I would consider before doing it.- Is my income secure, and do I have other sources of cash for emergencies?

One can have his policy significantly gutted if he is unable to make the interest payments for several years. The policy could even lapse, reversing into tax liabilities any tax advantages this process may have had. - Does paying interest to a bank really bother me that much?

Proponents love the fact that they are "paying themselves back" instead of feeding greedy bankers. Me? "Meh." - Is my policy from a conservative mutual life insurance company?

Well, yes it is. The company's earnings need not be split between policyholders and stockholders. They are not likely to run into financial difficulties due to short-term decision making and/or outright stupidity. (Did you notice that the mutual life insurance companies were barely phased by the 2008 "financial meltdown"?) - Is the economy undergoing a period of high inflation?

Believe it or not, this is the time I would seriously consider taking out a policy loan. As the economy underwent the Nixon/Ford/Carter years of high inflation, many folks with participating whole life policies were able to take out policy loans at 4% or 5%, and invest it into a CD at 10% to 12%. I could certainly see myself being my own banker with that kind of deal. (Modern insurance policies have higher loan interest rates; I am sure the companies did not like seeing much of their reserves end up in banks and credit unions. It might still work, though -- just not as dramatically well.)

- Is my income secure, and do I have other sources of cash for emergencies?